Canon Q2 2022 Financial Results Published (RF lenses did the job)

Here are the Canon Q2 2022 financial results. RF mount lenses led to a double-digit sales growth.

Says Canon about the business in general:

As for the second quarter, due to things such as the prolonged Russia-Ukraine conflict and Shanghai’s COVID lockdown, and accelerating global inflation, there is growing uncertainty about the future direction of the global economy. Despite this,

demand for our products remained firm. That said, the impact from Shanghai’s COVID lockdown was larger than expected, and we were unable to produce products in the quantity we planned for in the second quarter. Though this will

impact sales in the third quarter, we were able to expand sales in the second quarter by taking advantage of our inventory.

Net sales increased by 13.3% to 998.8 billion yen, or nearly 1 trillion yen. And we achieved our sixth consecutive quarter of net sales growth. As for profit, although the rise in material and logistical costs continue to affect us, in addition to adjusting prices, we raised the ratio of sales of high price range products, such as full-frame cameras and medium- to high-speed color MFDs.

Additionally, by controlling the rise in expenses even while sales were increasing, we increased operating profit by 27.4%, significantly raising it to 98.5 billion yen.

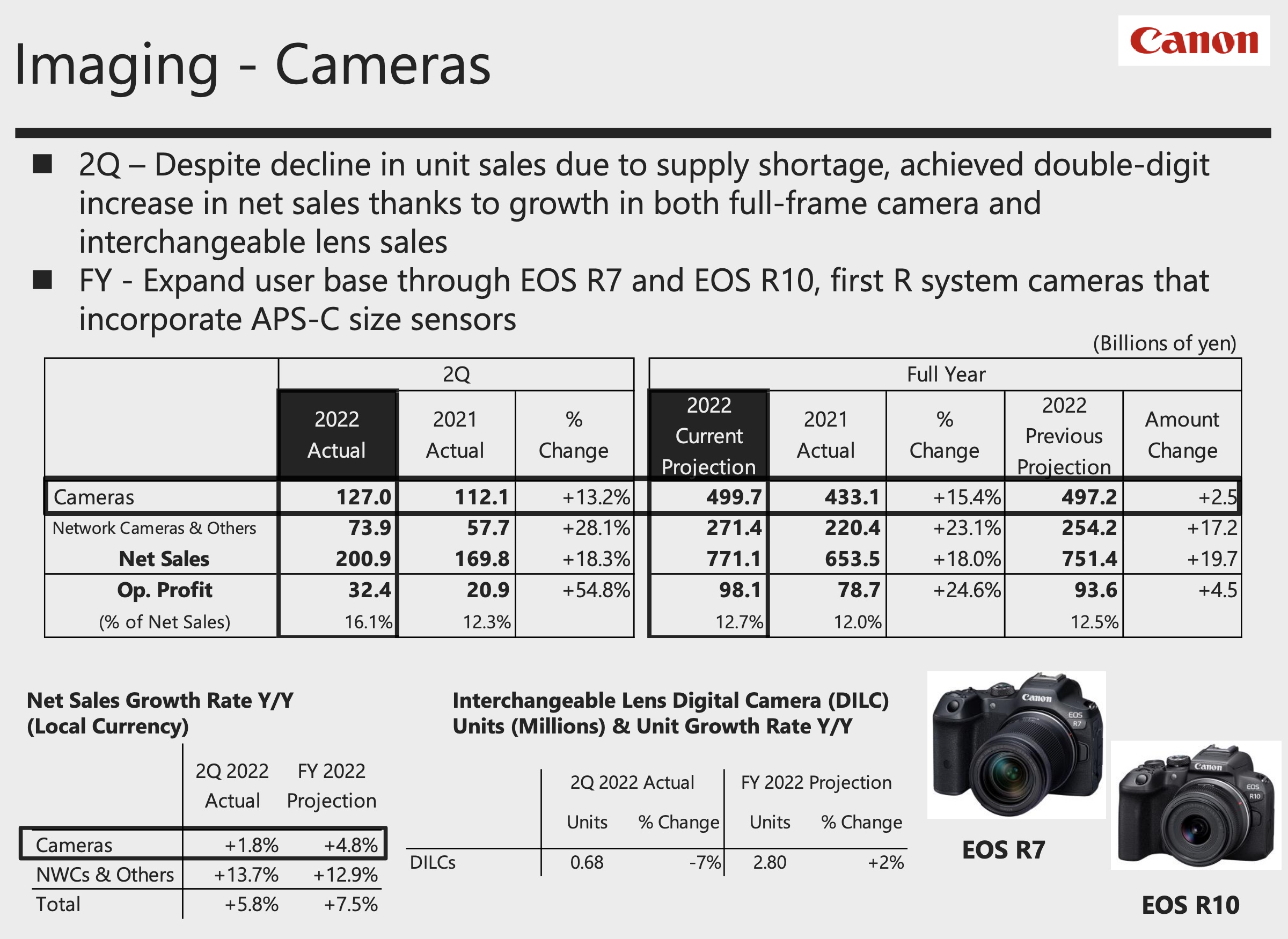

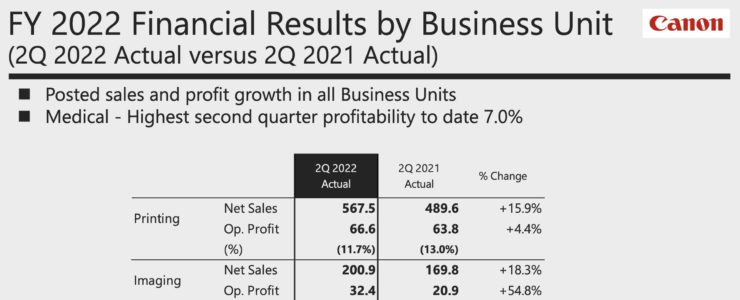

From Canon’s documentation, regarding the imaging business in Q2 2022:

As for the Imaging Business Unit, unit sales of interchangeable-lens digital cameras were below those of the same period of the previous year due to the shortage of products supply. However, unit sales of mirrorless cameras were above those of the same period of the previous year due to strong demand for the full-frame mirrorless cameras including the EOS R5 and EOS R6 and the favorable reviews of the new EOS R7. Unit sales increased significantly owing to strong sales of RF-series interchangeable lenses, which expanded the product lineup. As for network cameras, sales increased significantly mainly as a result of strengthening sales in response to diversifying market needs in addition to the recovery of products supply. As for professional video production equipment, sales of Cinema EOS-series including the new EOS R5 C, professional video cameras and broadcast

lenses, were strong. These factors resulted in total sales for the business unit of ¥200.9 billion, a year-on-year increase of 18.3%, while income before income taxes increased by 57.5% year-on-year to ¥32.9 billion mainly as a result of improved profitability due to an enhanced product mix. Sales for the combined first six months of the year totaled ¥358.1 billion, a year-on-year increase of 12.4%, while income before income taxes totaled ¥46.6 billion, a year-on-year increase of 19.7%